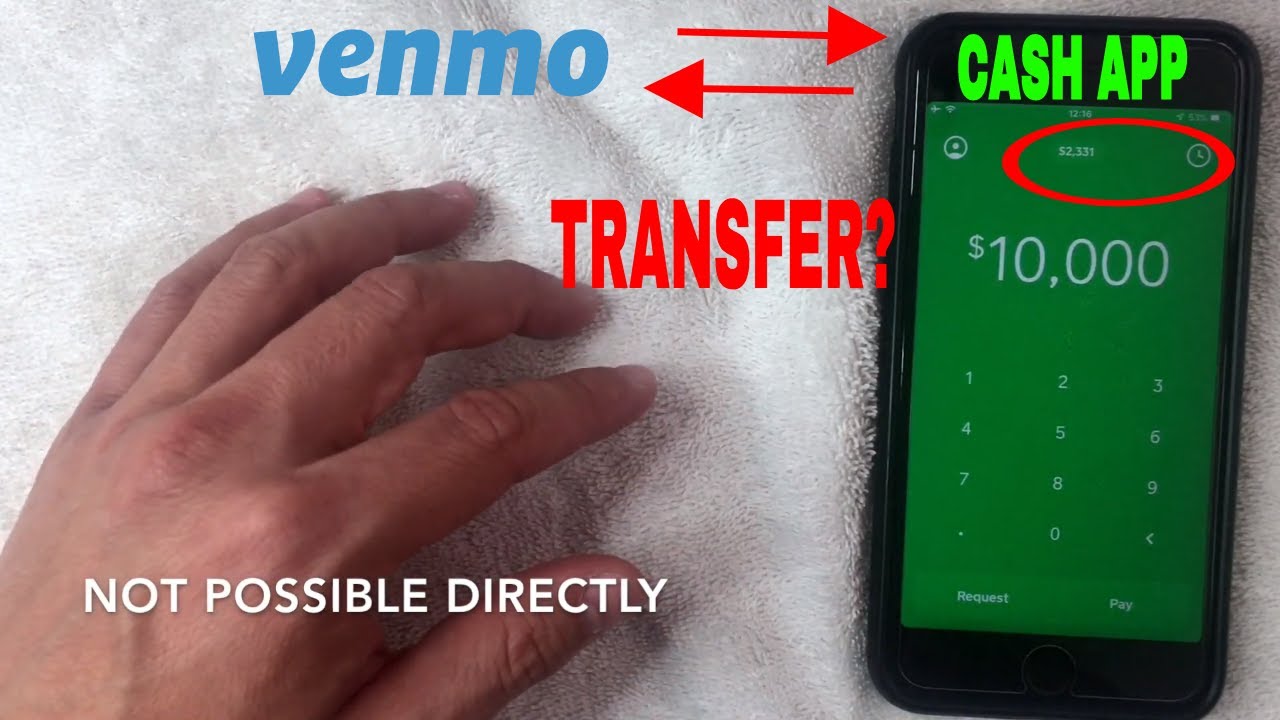

can you transfer money from cash app to venmo

The cash out feature is a built-in option for the Cash app that allows you to transfer your money into an account of your choice. You can instantly send or receive money with little or no fees.

4 Ways To Avoid Cash App Scams Sdfcu

Money can also be directly transferred if youve got enough funds stored in your Venmo wallet.

. Peer-to-peer P2P payment apps like Venmo PayPal Cash App and Zelle let you send money to friends or family or pay small businesses directly from your bank account. Make sure you also generally meet the credit issuers criteria. For the transfers made with a credit card Cash App charges 3 of the total fee whereas debit card transfers are completely free.

In addition Cash App does not charge you any fee to add money to your Cash App card until or unless you use a credit card. Peer-to-peer money transfer apps like the Cash App and Venmo are one of the conveniences brought to us by advancing technology. In fact instead of transferring money from your credit card to a prepaid card online you can transfer the money from your Cash App to the prepaid card if you have already linked your.

Choosing the best money transfer app comes down to cost security and ease. You can cash out with the app in one of two ways. Its never been easier to send and transfer money directly from your mobile device.

Transfer of money is quick to bank accounts as you can send money using routing number to someoneâs account. The Pros of Venmo. Unverified Cash App users can send 1000 in a month.

After 9 months we review your account for a credit line increase. From splitting dinner to sending money to a friend or business applications like Zelle Venmo and Cash App have revolutionized how consumers move money allowing transfers in seconds without needing to ever having to write a check or handle cash. Heres how this task can be performed without any hassle.

There are no physical locations. That way you can also use the money for other purchases. It works by linking your credit card or bank account to the app.

Venmo CashApp and other third-party apps to report payments of 600 or more to the IRS. Cash App makes it. Cash App and Venmo are widely used peer-to-peer P2P mobile payment apps.

Once the account is created youll be able to receive money from other users or transfer money into your Cash App balance from your linked bank account. With Your Cash App Card. The card works like any debit card you would get from a bank so you can use your Cash App balance on PayPal.

Cash App doesnt charge fees for most basic services Cash App is free to use. New users are only allowed to send up to 250 roughly 314 and receive up to 500 around 630 during a seven-day period. Instead of having to exchange bills and make change when someone.

Select picked the top apps for sending money to friends family and even some small businesses. You will receive a Form. Both PayPal and Cash App are being extensively used by many customers around the globe.

A lower interest rate means you will pay less money toward interest charges as you pay down the balance. Cash App charges a fee for instant transfers 05 to 175 of the transfer amount with a minimum fee of 025 but you can also choose a no-fee standard transfer which typically takes one to. Verified Cash App users can send 7500 in a week.

You can spend send or transfer Venmo money. Cash App itself is a digital wallet just like other wallets such as Google Pay Facebook Pay and Venmo among others. No additional deposit.

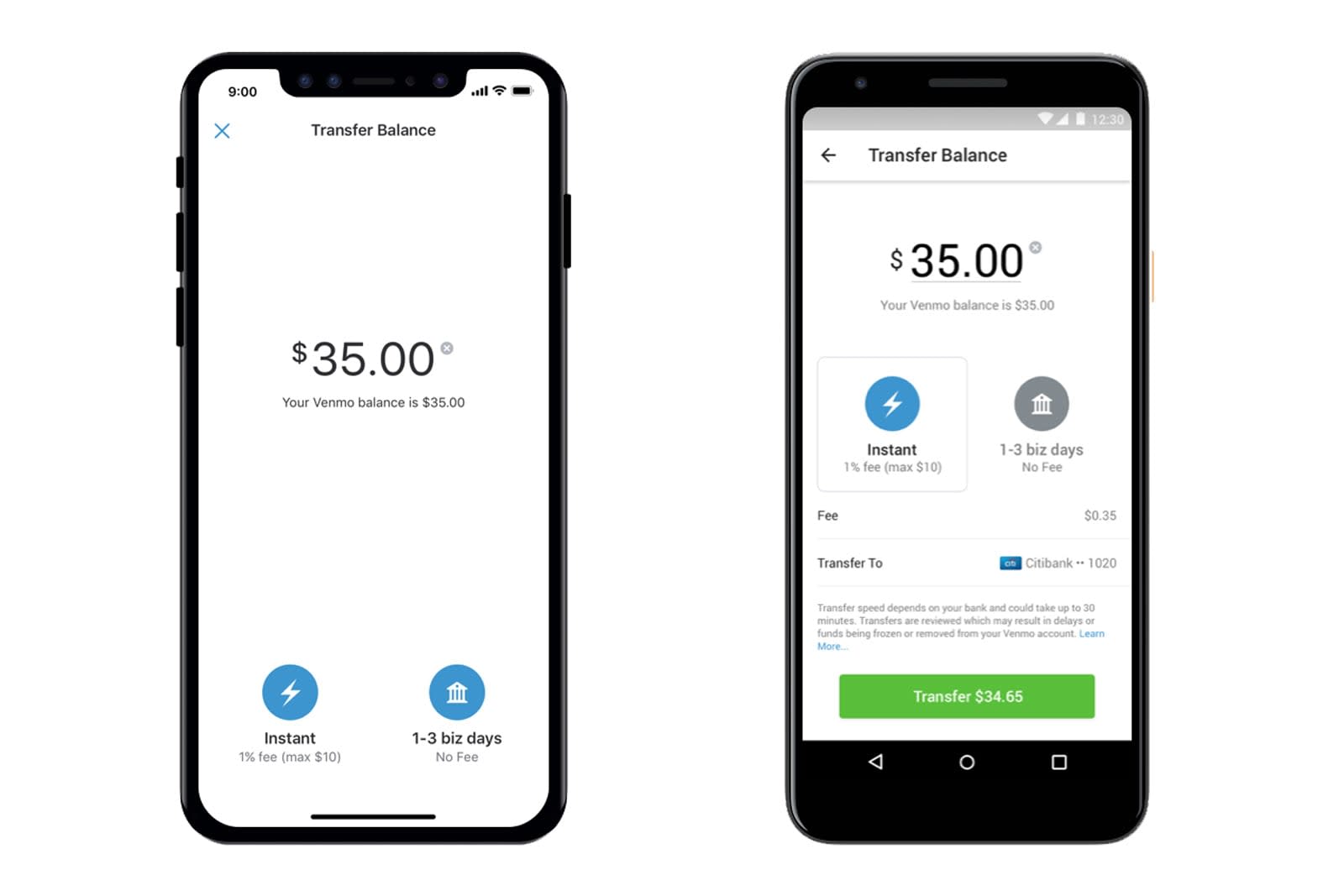

Unverified Cash App users can send 250 in a week. You can use Venmo Card to transfer money from Venmo App to Cash App Send Venmo Money to Cash App via a bank account whereby you have linked both Venmo and Cash App accounts to the bank account or Transfer Venmo Money to Cash App through Cash App Cash Debit Card. It is easy to transfer money from Venmo App to Cash App.

The plus side is you can access your account on multiple mobile devices. This service can help you send your share of utilities to your roommates pay. Choose your own credit line based on how much money you want to put down as a security deposit.

Create Your Chime Account And Cash App Account. You can send attached notes with emojis too for each payment. To cash out funds from your Cash App to your bank account.

How To Cash Out With The Cash App. You can increase your credit line at any time by adding additional money to your security deposit up to 3000. Venmo offers the best of both worldsit offers a quick and easy way to send and receive money and offers a potential parking place for your cash.

But not all P2P apps. Cash App is a completely online money transfer app. Squares Cash App is a mobile peer-to-peer payment app like Venmo that allows you to transfer money to family and friends without even having to be in the same room.

Its a good idea to know what your credit score is so that you can target your search to a card youre more likely to get approved for. Theres a 1 charge if you move money out of your Venmo account and into a bank account if you. That allows users to send and receive money.

Before you can worry about how to transfer money from Chime to Cash App the first thing is to ensure that you have successfully set up both account. Cash App is a peer-to-peer money transfer service developed by Block Inc. PayPal bore Venmo and the platform is quickly growing.

Read on to learn why. Miles or cash back. Venmo or debit card accounts.

Cash Apps transfer limit is 7500 transfer while Google Play has a. Azimo has reasonable fees for. Venmo debit and credit cards are available.

See our full article on. Both allow you to send and receive money from your smartphone. Initial deposits can be from 200 to 3000.

Azimo - has an app in the Google play store and appleâs app store. PayPal and Cash App Two Best Money Transfer Apps. But while these two apps offer similar features and.

Simple Guide On How Transfer Money From Chime To Cash App. Understanding your Form 1099-K for Cash App Tax Reporting. You can use a credit card to pay for a money order but it should be thought of as a last resort.

What Is a Money Order. You can only deposit money into your account using another external bank account. A money order is an alternative to checks or cash when you need to make a secure payment and cant or dont want to use your banks online payment options or an online payment app such as Venmo or PayPal.

If you dont want to use your bank account you can also apply for and use a Cash App card.

Cash App Vs Venmo 2022 Comparison Pros Cons

Cash App Vs Venmo What Is Better For Mobile Payments

Cash App To Venmo How To Transfer Money From Cash App To Venmo Retirepedia

How To Transfer Money From Cash App To Venmo 3 Easy Steps Almvest

How To Send Money From Cash App To Venmo Step By Step

Cash App Vs Venmo Which Is For You

Cash App To Venmo How To Transfer Money From Cash App To Venmo Retirepedia

How To Transfer Money From Your Cash App To Your Bank Account Gobankingrates

Everything To Know About Venmo Cash App And Zelle Money

How To Instant Transfer Money From Cash App To Venmo Youtube

Can I Sue A Money Transfer App Like Venmo Or Cash App Findlaw

Can You Transfer Money Between Venmo And Cash App Youtube

What Venmo And Cash App Users Need To Know About New Tax Rules Financebuzz

How To Transfer Money From Cash App To Venmo 3 Easy Steps Almvest

How To Transfer Money From Venmo To Cash App Simple Step By Step Almvest

How To Instant Transfer Money From Venmo To Cash App Youtube

Can You Cash App To Venmo Yes Follow These Steps